There’s no denying that credit can be a useful financial tool, but it’s not smart to use in all circumstances. Some purchases on credit can lead to lasting debt and other hardly manageable problems, and we’ve compiled a few of these purchases you need to steer clear of.

Dining Out

Another problematic credit habit to get into is frequent dining at restaurants. If you choose to eat out regularly, you should pay in cash; using credit cards for meals adds up quickly, influencing you to purchase expensive food and drinks you wouldn’t normally go for.

Furniture

One of the most common purchases on credit is home furnishings, as people justify it by thinking about how long they will use the furniture for. However, you’ll only end up spending much more than the pieces are worth, so you should instead save up or purchase second-hand.

Wedding Expenses

Nobody wants to cheap out on their wedding, but it’s important to remember that charging wedding expenses to a credit card can lead to long-term financial burdens. In the future, this could overshadow the joy of the occasion, potentially causing stress in newlywed life.

Luxury Clothing

When you see luxury clothing you can’t afford, purchasing it on credit is tempting. However, this can quickly become a bad habit. According to Afterbreak Magazine, fashion changes rapidly these days, so you likely won’t even be wearing pieces by the time you’ve paid them off.

Electronics

Another product that depreciated in value rapidly is electronics, so buying them on credit means you might still be paying for an outdated item long after it’s no longer useful. It’s wiser to save credit for other purchases, only buying electronics that you can pay for in cash.

Vacation Packages

It can be very tempting to pay for a much-needed vacation on finance, but doing so can quickly turn a dream vacation into a financial nightmare. Interest on these expenses can add up fast, extending your repayment period and causing stress, leaving you questioning whether the decision was worth it.

Jewelry

No matter how glitzy and glamorous it looks, it’s never worth buying jewelry on credit. Paying interest on these purchases can inflate costs significantly over time, making what seemed like a special purchase a financial regret. Unless it’s pure diamond, the resell value is going to decline quickly, too.

Gym Memberships

Fitness is important, but you should still never buy gym memberships on credit. Locking into a contract when you can’t afford it can result in you paying through the nose for services that you may not even use consistently, resulting in wasted money and ongoing debt.

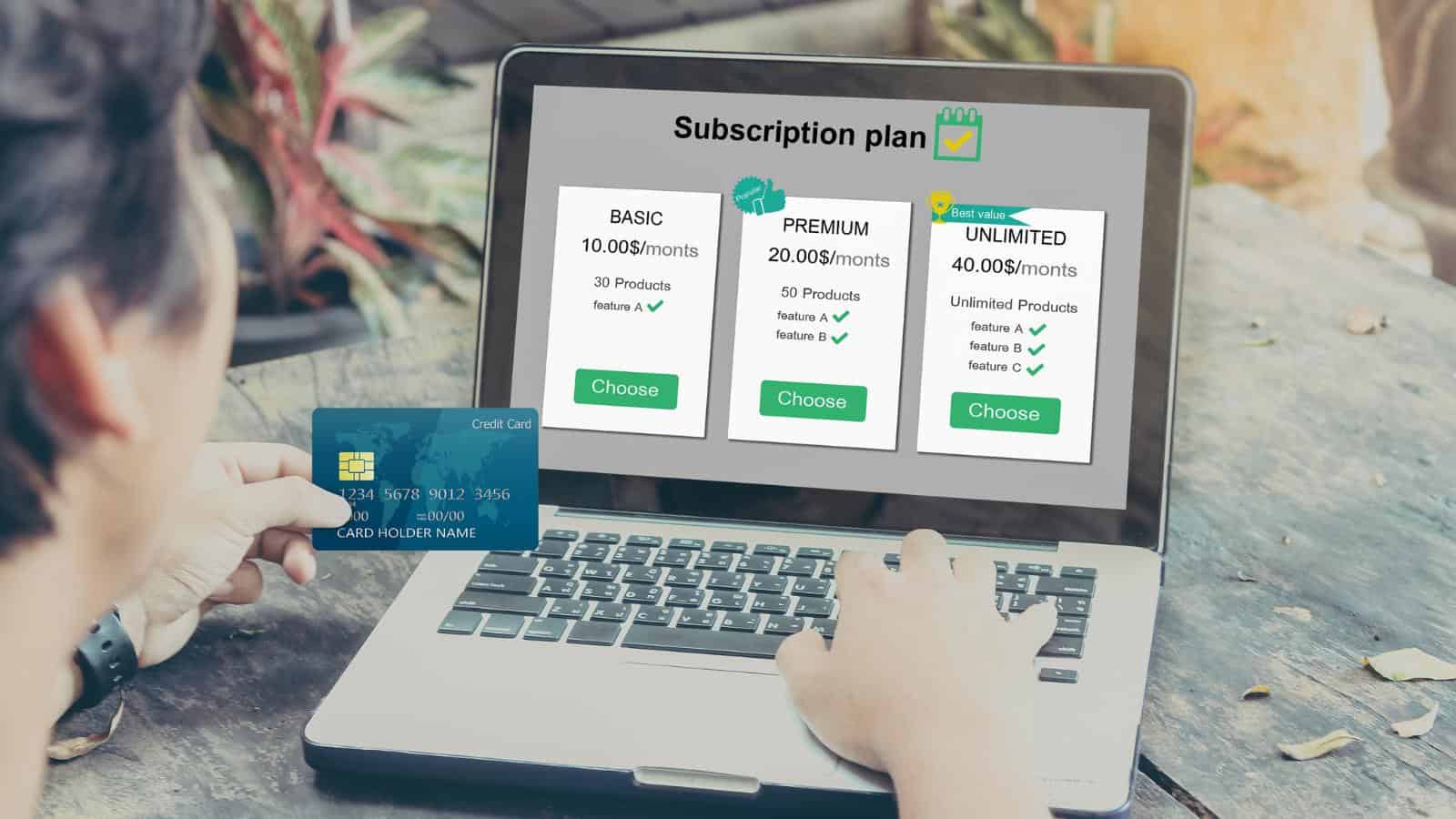

Subscription Services

The recurring charges for streaming services, magazines, or online tools should be managed within a budget, so putting them on credit isn’t wise. Furthermore, they’re luxury services that aren’t necessary, so don’t ruin your financial situation for some additional entertainment.

Home Improvements

It’s normal to aim to improve your living spaces, but this should always be funded through savings or, at the very least, home improvement loans. Credit cards are subject to much higher credit rates than home improvement loans, not to mention extended debt periods, making the improvements far costlier.

Medical Bills

The costs of healthcare are overwhelming for most people, but it’s still not wise to put them on credit; you’ll live to regret this. There are plenty of better solutions, such as better preparing your insurance plans or making use of healthcare provider payment plans.

Car Repairs

It’s always frustrating when your vehicle requires unexpected repairs, especially if you can’t afford them at the time. However, don’t start funding these with credit because that could quickly lead you into financial hardship. Sadly, the only solution to this is saving an emergency fund in preparation.

Pet Purchases

Most people agree that pets are priceless, but their costs can be very high. Even if you’re struggling to pay for veterinary bills, it’s still important to consider payment plans instead of paying on credit. Better still, only buy a pet if you know you can afford it.

Clothing for Kids

We love to see our children grow up, but this can make purchasing clothing expensive as they grow out of items so quickly. This is precisely why charging kids’ clothing on credit is an awful idea, as it creates a vicious cycle. If you’re struggling, just purchase secondhand.

Smart Home Devices

The latest tech trends are enticing, especially the futuristic innovations of smart home devices, but you should ask yourself whether they’re really necessary. If you can afford them, treat yourself, but if you can’t, putting yourself into debt through a credit card is pretty irresponsible and unnecessary.

Collectibles

If you’re into collectibles, be careful not to get carried away with your credit card. Many collectors overestimate how much their rare pieces are worth, so while purchasing on credit might seem like a good investment, it’s often not. Do your research to make sure you don’t bankrupt yourself.

Hobbies

As with collectibles, the costs of any hobby can add up, especially when you get carried away in the moment. However, hobbies don’t have to be expensive; many are free or at least very cheap, and secondhand equipment is always available, so don’t let your hobby ruin your credit.

Seasonal Decorations

It may be surprising to some that festive decorations are actually a very common, albeit unwise, credit card purchase. When faced with the financial pressures of the holiday season, people don’t want to go without the festive joy, but being realistic, they should just reuse old decorations if they’re struggling.

Music Equipment

As it lasts for years, many aspiring musicians choose to pay for music equipment on credit, but this is a common trap to fall into. It will only make you spend more on equipment you can’t afford when you probably could just pay less for more budget or secondhand gear.