Financial stability is crucial, yet many millennials find themselves repeatedly caught in common monetary pitfalls. Understanding these challenges can help avoid them, and this is why we’ve helped you explain the most common financial traps that you should be aware of to protect your finances.

Credit Card Debt

Credit cards offer convenience, but the high interest rates can quickly accumulate debt. Paying only the minimum balance each month prolongs the debt cycle, making it harder to achieve financial freedom. To prevent this, it’s crucial to avoid unnecessary purchases, create a budget, and pay off balances in full each month.

Car Loans

Opting for expensive car loans can strain finances due to high monthly payments and interest rates. Purchasing a reliable used car or exploring public transportation can reduce this financial burden and save money in the long run.

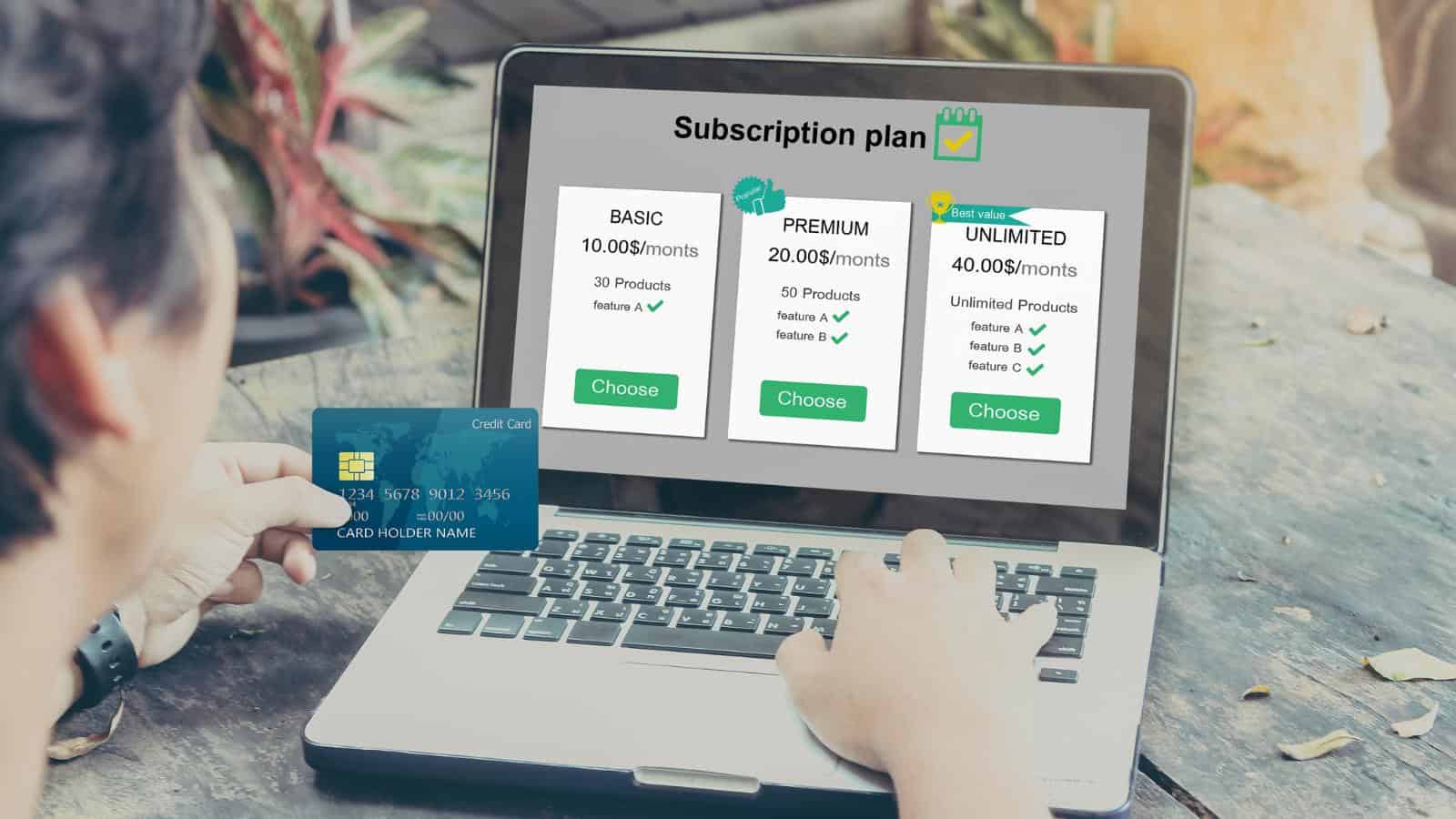

Subscription Services

Numerous subscription services can quickly accumulate, significantly draining monthly budgets. To manage finances more effectively, it’s crucial to regularly review and cancel unnecessary subscriptions. This practice can free up valuable funds, allowing for allocation towards more important financial priorities, such as savings, investments, or essential daily expenses.

Living Beyond Means

Spending beyond one’s income results in debt accumulation. High living costs and the pursuit of a luxurious lifestyle exacerbate the problem. To avoid financial instability, it’s crucial to adhere to a strict budget, focus on needs over wants, and manage expenses wisely.

Ignoring Retirement Savings

Many millennials delay saving for retirement, assuming it can wait. However, starting early allows for compound interest to grow savings significantly. Even small contributions to retirement accounts can make a substantial difference over time.

High Rent Expenses

Spending excessively on rent can significantly limit financial growth. Opting for affordable housing options and considering roommates can substantially reduce monthly expenses. By saving the difference, individuals can allocate funds towards future investments, build an emergency fund, or achieve financial goals such as buying a home or starting a business.

Overdraft Fees

Frequent overdraft fees often signify poor financial management. To prevent overdrafts, it’s crucial to monitor account balances closely and set up alerts for low balances. Additionally, maintaining a buffer in checking accounts can provide a safety net, ensuring that transactions don’t exceed available funds and avoiding costly fees.

Lack of Financial Literacy

Many millennials struggle with basic financial literacy, which often results in poor financial decisions that can impact their long-term financial well-being. By actively seeking educational resources and professional financial advice, individuals can significantly enhance their understanding of key financial concepts and improve their money management skills, ultimately fostering better financial health and stability.

Lack of Emergency Fund

Unexpected expenses can arise at any time, yet many millennials lack an emergency fund. This financial safety net is essential for covering sudden costs such as medical emergencies, car repairs, or job loss. Building an emergency fund helps ensure financial stability and peace of mind during unpredictable situations, highlighting its critical importance. Setting aside a small portion of income regularly can help build this crucial fund.

Impulsive Spending

Impulse buying can significantly derail budgeting efforts, leading to unnecessary debt and financial stress. Avoiding spontaneous purchases by making thoughtful spending decisions is crucial. Creating a detailed shopping list and adhering to it helps control impulsive spending habits, ensuring that you stay within your budget and achieve your financial goals.

Neglecting Health Insurance

Skipping health insurance to save money can backfire significantly if medical emergencies arise. Without coverage, high medical costs can lead to financial hardship. Health insurance offers essential protection, ensuring financial security and peace of mind. It’s crucial to explore and choose affordable insurance options to maintain both physical and financial well-being.

High-interest Loans

Taking out high-interest loans for quick cash can lead to long-term debt issues. Seeking lower-interest alternatives and avoiding payday loans can protect financial stability. Careful consideration of loan terms prevents falling into this trap.

Ignoring Credit Scores

Neglecting to monitor and maintain a good credit score impacts future financial opportunities. Regularly checking credit reports and addressing errors promptly can improve scores. Responsible credit use and timely payments enhance credit health.

Lifestyle Inflation

As income increases, spending often rises accordingly, a phenomenon known as lifestyle inflation. This occurs when individuals upgrade their living standards, purchasing more luxurious items and services. Avoiding unnecessary lifestyle upgrades and maintaining a modest budget can significantly enhance savings, providing greater long-term financial security and the ability to invest in future opportunities.

Payday Loans

Payday loans provide immediate cash but are often accompanied by extremely high interest rates and fees, leading to a cycle of debt. To avoid this, consider alternative financial solutions like personal loans, credit unions, or emergency funds. Effective budgeting and saving for unforeseen expenses can also help maintain financial stability and health.

FOMO Spending

Fear of missing out (FOMO) drives many to overspend on social activities and trends. Prioritizing personal financial goals over social pressures can prevent overspending. Mindful spending decisions foster financial stability.

Neglecting Investment Opportunities

Many millennials hesitate to invest, missing out on potential wealth growth. Educating oneself about investment options and starting with small, manageable investments can build a solid financial foundation for the future.