There’s a common misconception that you need to make serious sacrifices in order to save money in life, but that’s just not true. In reality, there are countless small details of your day-to-day spending that you can tweak, and they’ll all add up to save you a significant sum. To show you how, here are 20 simple ways to save money without changing your lifestyle too dramatically.

Automate Your Savings

As Business Insider recommends, if you’re looking to start saving more money, the first thing you should do is set up an automatic transfer to your savings account on payday. This method ensures you’re consistently saving without having to think about it. Over time, this habit builds a cushion without any extra effort on your part, making it a seriously effective way to make saving a non-negotiable part of your routine.

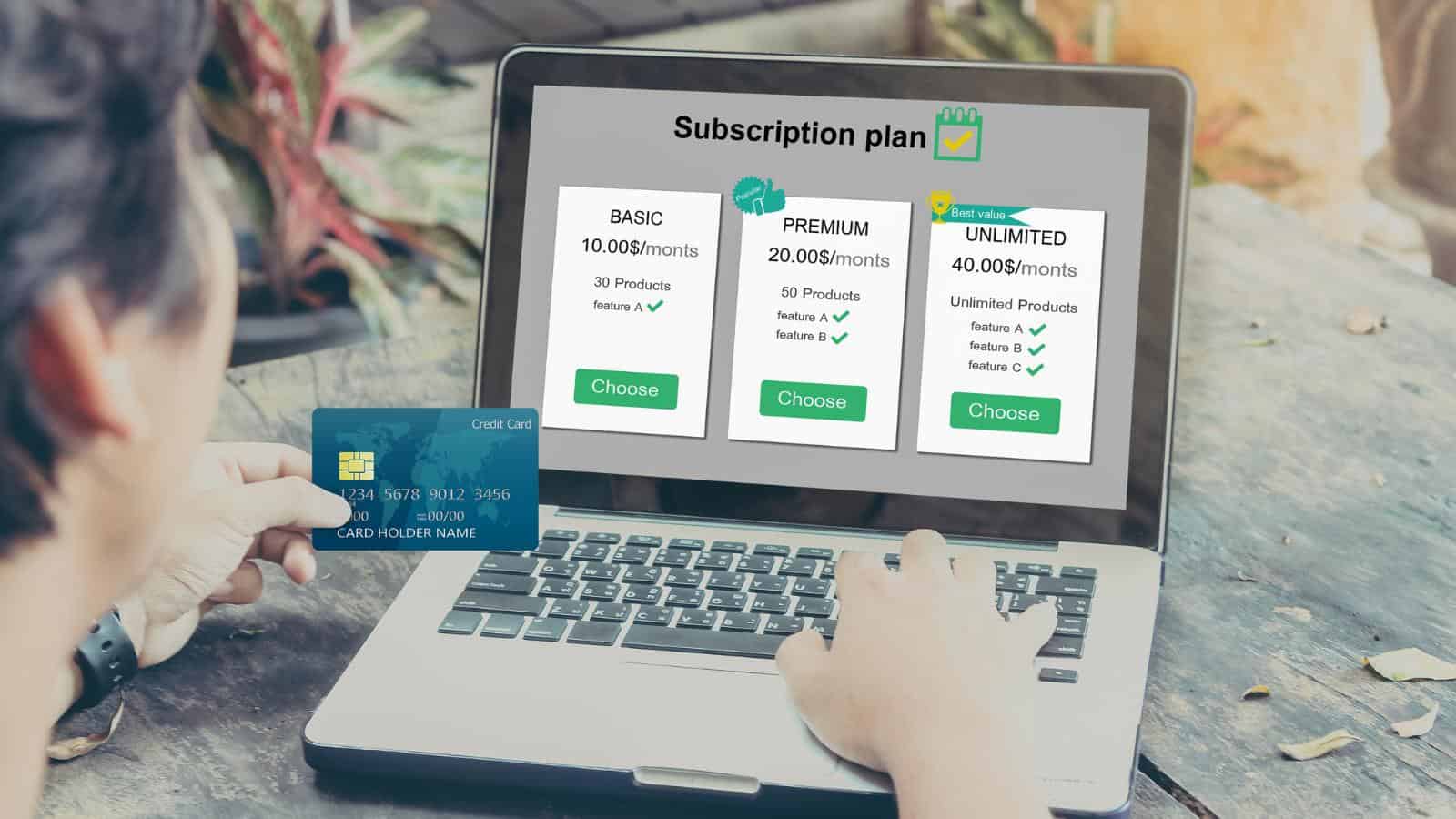

Cut Out Unused Subscriptions

It’s a very wise idea to review your bank statements regularly and sum up any recurring charges. You might be surprised at how many old subscriptions you’ve forgotten about or services you no longer use. It’s more common than you might think, so don’t act like you don’t do it, too; cancel these unnecessary expenses, and you might find yourself with a lot more disposable income.

Use Cashback and Rewards Programs

In the UK, more and more shops are supporting cashback apps and rewards programs, and you’d be mad not to take advantage of them. Even if you only save a few pennies, these small percentages add up over time. Think of it like you’re essentially getting paid to shop, so long as you’re not buying things you wouldn’t normally need.

Cook More at Home

Perhaps the easiest way to save more money without changing up your lifestyle too much is to start cooking more at home instead of dining out or ordering a takeaway. Homemade meals are almost always cheaper and healthier than dine-out options, and by planning your meals in advance, you can make the most of your groceries and avoid waste, further stretching your budget.

Set Up a Budget

Speaking of budgeting, you’ll never be able to save money if you don’t have a clear budget set out, which will help you track your income and expenses. This will make it easier to identify where you can cut back, with even the smallest of adjustments making a noticeable difference.

Buy Generic Brands

If you usually buy fancy brand names, make the switch to generic brands, and you won’t believe how much cash you’ll save. Often, these products are just as good as their name-brand counterparts but at a fraction of the cost, so stop pouring money down the drain and let go of your brand loyalty.

Pay Off High-Interest Debt

When you get stuck in debt, it can feel like it’s inescapable, but there’s always a way out. Focus on paying off debts with the highest interest rates first, as reducing these debts can save you a substantial amount in interest payments over time. Once these are eventually paid off, you’ll have more money available for saving or other financial goals without feeling like you’re cutting back.

Negotiate Your Bills

Believe it or not, it’s absolutely possible to negotiate when it comes to paying your bills. Contact your service providers to negotiate lower rates on your bills, and you’ll find that many companies offer discounts or promotions if you ask–especially if you’ve been a loyal customer.

Shop Second-Hand

It’s always smart to consider buying clothes, furniture, and other items from charity shops, online marketplaces, or car boot sales. Pre-owned goods can be just as good as new ones, and generally, they’re sold at a far lower price. Best of all, it also gives preloved items a second life, so you’ll be contributing to a sustainable consumer culture, too.

Plan Your Grocery Shopping

If you haven’t already started making a shopping list before you head to the supermarket, it’s time to change that now. Write down all the essentials you know you will need, and stick to them. This strategy prevents impulse buys and ensures you only purchase what you need. After all, we all know that it’s easy to buy groceries with our taste buds rather than our brains.

Limit Impulse Purchases

While you might think that the occasional impulse purchase is harmless, you’d be surprised at how much it’s draining your bank account. To prevent this, before making a non-essential purchase, take a step back and give yourself a day or two to think it over. This cooling-off period can help you avoid spending on things you don’t really need, and you’ll soon find yourself saving money.

Use Public Transportation

Another top money-saving tip is to consider using public transportation or carpooling when possible. It’s often cheaper than driving, especially when you factor in gas, parking, and maintenance costs. However you achieve it, reducing the number of times you use your car each week will always lead to significant savings over time.

Unplug Electronics

Some people claim that unplugging devices only save a marginal amount of savings, and whilst this may be true, you’re still saving money. Even when turned off, many of your electronics draw power if they’re still plugged in, so by simply unplugging them or using a power strip, you can cut down on your electricity usage and lower your monthly expenses.

Set Savings Goals

Even if you’re being frugal with your spending, it can be difficult to save money if you don’t know what you’re aiming for. So, try to establish some specific savings goals, such as saving for a vacation, an emergency fund, or a major purchase. Having a clear target gives you something to work toward and can motivate you to save more consistently, so it will likely improve your saving efficiency dramatically.

Take Advantage of Free Entertainment

These days, there are so many paid streaming platforms and video games out there that we forget how many free entertainment options there are. Community events, parks, and library resources are all generally free, and best of all, they’re far more fun than being stuck inside staring at a TV screen.

Cut Back on Coffee Runs

If you regularly buy takeaway coffees during your day, ditching these should be your first step toward saving money. Making your coffee at home is so easily customizable, and it’s generally tastier and it’s so much cheaper, too. Invest in a good coffee maker and quality beans, grab a reusable coffee flask, and you can enjoy whatever fancy coffees you’d like for much cheaper than a takeaway coffee.

Use Vouchers and Discount Codes

Sometimes, cash-back apps aren’t available for British shops but don’t give up hope because vouchers and discount codes might be available. Before making a purchase, search for coupons or discount codes online, as many retailers offer exclusive online promotions that can significantly reduce your costs. This simple habit can make a big difference in how much you spend, so don’t overlook it.

Reduce Water Usage

While it might sound overly simple, try to be mindful of how much water you’re using, and you’ll always save money. Sure, your water bill might be one of your cheapest utilities, but it still adds up, so making simple changes like taking shorter showers, fixing leaks, and using water-efficient appliances can really make a difference.

Avoid ATM Fees

Thankfully, British ATMs usually don’t come with fees, but they do exist, especially on busy high streets. They’re very common abroad, too, so whenever you need to take money out, it’s well worth shopping around to find an ATM that is 100% free. It’s worth grabbing yourself an international payment card too for foreign use, helping you to avoid ForEx commissions.

Sell Unused Items

If you’ve gone through all of these tips and still want to save more money, consider going through your home and finding old items you no longer need or use. Selling these items online or at a garage sale can bring in some extra cash, and let’s be real–you were never going to use them again anyway, so there’s really no point in holding on to them for the sake of it.